The Cambodia Accounting Forum 2025 (ACAR Event), held on September 4, 2025 at Koh Pich Convention and Exhibition Center, focused on “Regulatory Harmonization, Sustainability and Digital Financial Reporting.” The presentations provided clear and accelerating mandates for financial transformation in Cambodia, confirming the urgent market demand for compliant, online accounting technology.

Vithean: A Critical ‘Digital Financial Report Enabler’

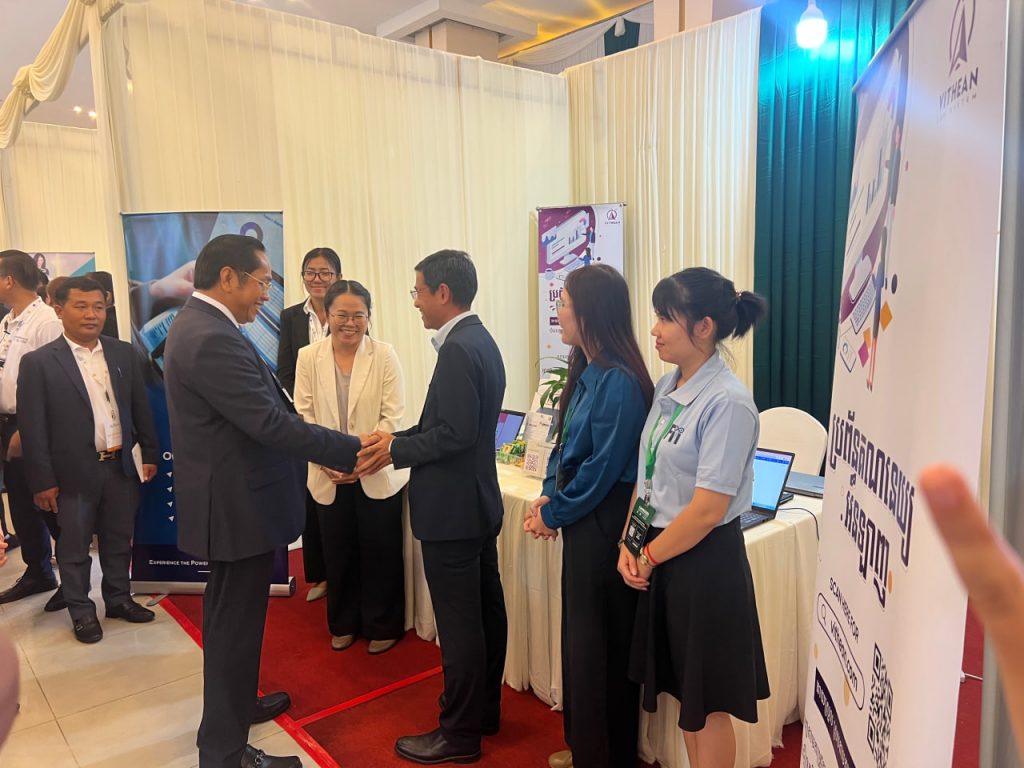

Vithean’s Online Accounting solution (https://vithean.com) was a prominent exhibitor at the event, underscoring our commitment to supporting Cambodia’s financial transformation. Our presence directly addressed the need for modern tools to handle the new regulatory landscape.

As regulators confirm the mandatory shift to digital filing, Vithean is positioned as a critical ‘Digital Financial Report Enabler.’ Our system is designed to address the key challenges highlighted at the forum: ensuring businesses achieve immediate compliance, streamlining the process of digital data tagging, and providing the foundational technology necessary for all future reporting requirements.

Key Takeaways from the ACAR Event Presentations

1. Digital Financial Reporting and Mandatory Standardization

The government has prioritized the Digital Financial Reporting initiative, aligning it with the national Digital Economy and Society Policy Framework 2021-2035 to enhance transparency and foster technological innovation.

- Immediate Roadmap (2025-2026): The initial “Digital Foundation” phase requires businesses to adopt specific new standards:

- Reporting under the Cambodia Reduced Financial Reporting Framework (CRFRF).

- Mandatory use of a Standard Chart of Accounts.

- Digital reports must be submitted in JSON format using the new ACAR Accounting Taxonomy.

- Long-Term Vision: The strategy outlines a transition to XBRL format for digital reporting, a global standard that turns reporting into a powerful tool for data analytics and strategic insights. This machine-readable format is key for future-proofing business data.

2. Mandatory Adoption of IFRS Sustainability Reporting

Cambodia is firmly committed to adopting the global benchmark for sustainability reporting, specifically the IFRS Sustainability Disclosure Standards (IFRS S1 and S2), issued by the International Sustainability Standards Board (ISSB).

- Strategic Imperative: The move is essential for attracting international investment, strengthening financial stability, and aligning Cambodia with the ASEAN region, where 85% of regional GDP is represented by economies signaling their intent to adopt the ISSB Standards.

- Implementation Focus: The Accounting and Auditing Regulator (ACAR) will lead a phased roadmap that focuses heavily on capacity building (training professionals) and leveraging digital solutions to make this complex new compliance requirement efficient, especially for SMEs.

3. Updates on Financial Reporting Standards (IFRS for SMEs)

- New Standard: The Third Edition of the IFRS for SMEs (used as CIFRS for SMEs in Cambodia) was issued in February 2025.

- Effective Date: This updated standard is mandatory from January 1, 2027, confirming the continuous, dynamic nature of financial compliance in the Kingdom. Solutions like Vithean must be able to adapt quickly to these mandatory updates.